The Latest and Greatest

Things you actually want to read. That's all we plan to put out here. Educational, informational, slightly silly... but always completely honest content that's relevant. New posts will be showing up regularly, so don't forget to check back! Whatever your financial goals are this year, Texas Bay can help. From saving money to reducing debt to buying a home, we have a solution for you!

Home

2025-04-29

The Do’s and Don’ts of a Home Equity Loan

A home equity loan is a powerful financial tool that allows homeowners to borrow against the equity in their home. Whether you’re funding a home improvement project, consolidating debt, or covering unexpected expenses, this type of loan provides a lump sum with fixed payments. However, borrowing against your home comes with responsibilities. The Do’s of a Home Equity Loan 1. Do Understand Your Home Equity Before applying for a home equity loan, determine how much equity you have. Equity is calculated as: Home Value – Mortgage Balance = Home Equity Most lenders allow you to borrow up to 80% of your home’s value, minus your existing mortgage. Knowing this helps you set realistic borrowing expectations. 2. Do Use the Loan for Smart Financial Moves A home equity loan can be a great way to invest in your future. Consider using it for: Home renovations that increase property value Debt consolidation to lower interest rates Education expenses for long-term benefits Emergency expenses when...

Savings

2025-04-08

How to Teach Kids (7-14) to Budget and Save

April is Youth Financial Literacy Month and the perfect time to start teaching your ...

Home

2025-03-24

Affordable Homeownership with an FHA Loan

Making Homeownership Achievable with an FHA Loan For many aspiring homeowners, purc...

Looking for something specific?

Vehicle

2025-03-03

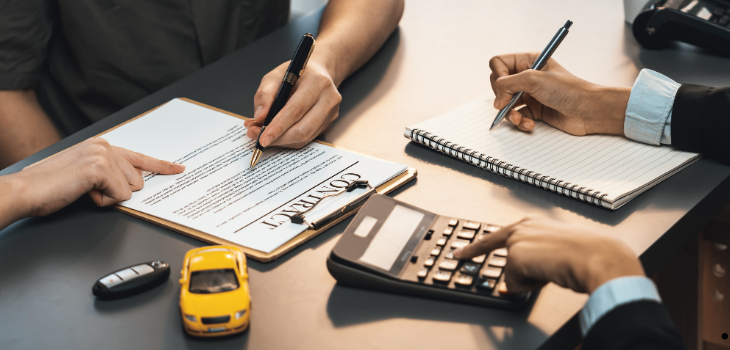

Read more about The Competitive Edge of a Credit Union Car LoanThe Competitive Edge of a Credit Union Car Loan

Today, borrowers have more options than ever when it comes to securing an auto lo...

Insurance

2025-02-10

Read more about Revisit Your Insurance Rates: Are You Paying Too Much?Revisit Your Insurance Rates: Are You Paying Too Much?

Insurance is one of those essential expenses that helps protect your financial futur...

Personal Finance

2025-01-27

Read more about Bigger Better BonusBigger Better Bonus

There’s nothing like the thrill of unexpected cash landing in your lap—whether it’s...

Personal Finance

2025-01-27

Read more about Piece Together Your 2025 Financial Goals with Texas Bay Credit UnionPiece Together Your 2025 Financial Goals with Texas Bay Credit Union

The start of a new year is the perfect time to reassess your finances and set goals ...

Home

2025-01-17

Read more about What is Cash-Out Refinancing and How Does it Work?What is Cash-Out Refinancing and How Does it Work?

Cash-out refinancing is a popular financial tool that allows homeowners to tap into...

Personal Finance

2025-01-13

Read more about Track Your Year in SpendingTrack Your Year in Spending

Why you should track your spending Clarity is power. Ever feel like you earn a decen...

Personal Finance

2025-01-06

Read more about How to Prepare for a Notary AppointmentHow to Prepare for a Notary Appointment

Whether you’re signing a contract, authorizing a power of attorney, or completing a...

Personal Finance

2024-12-30

Read more about 25 Ways to Save Money in 202525 Ways to Save Money in 2025

As we step into 2025, many of us are looking for practical ways to boost our saving...

Vehicle

2024-12-13

Read more about Why You Should Get Pre-Approved for an Auto LoanWhy You Should Get Pre-Approved for an Auto Loan

Purchasing a vehicle is an exciting milestone, but securing the right financing can ...

Personal Finance

2024-12-02

Read more about Strategies for Paying Down High Credit Card BalancesStrategies for Paying Down High Credit Card Balances

For many Americans, high credit card balances are a significant financial burden. C...

Personal Finance

2024-11-25

Read more about The Ultimate Guide to Smart Holiday BudgetingThe Ultimate Guide to Smart Holiday Budgeting

The holiday season is a time of joy, celebration, and togetherness, but it can also...

Vehicle

2024-11-21

Read more about Leasing vs. Buying: What’s the Best Choice for You?Leasing vs. Buying: What’s the Best Choice for You?

When it's time to get a new vehicle, many people face a major decision: should you l...

Vehicle

2024-11-11

Read more about Score the Best Deal on Your New Car - Here's How!Score the Best Deal on Your New Car - Here's How!

To get the best deal on a new car, key strategies include thorough research before v...

Personal Finance

2024-11-04

Read more about How Interest Rates WorkHow Interest Rates Work

A Primer for Beginners Understanding interest rates is crucial for anyone looking to...

Personal Finance

2024-10-21

Read more about The FIRE MovementThe FIRE Movement

What Is the FIRE Movement? The FIRE (Financial Independence, Retire Early) movement...

Personal Finance

2024-10-17

Read more about How You Can Use a Texas Bay Personal LoanHow You Can Use a Texas Bay Personal Loan

Maximize Your Financial Flexibility Life is full of planned and unplanned financi...

Security

2024-10-10

Read more about Protect Yourself from SkimmersProtect Yourself from Skimmers

A Comprehensive Guide In today’s increasingly digital world, card skimming has beco...

Personal Finance

2024-10-07

Read more about Estate Planning and Elder Financial ProtectionEstate Planning and Elder Financial Protection

What You Need to Know Estate planning is a critical step in ensuring your assets ar...

Personal Finance

2024-10-02

Read more about TBCU Checking Account Switch KitTBCU Checking Account Switch Kit

How to Switch Your Checking Account to Texas Bay Switching checking accounts might ...

Insurance

2024-09-30

Read more about Roof Coverage Change on Homeowner RenewalsRoof Coverage Change on Homeowner Renewals

Did Roof Coverage Change on Your Home Insurance Renewal? Home insurance is an essent...

Personal Finance

2024-09-23

Read more about Budgeting for Managing Credit Card DebtBudgeting for Managing Credit Card Debt

Managing high credit card debt can be daunting, especially when interest rates keep...

Insurance

2024-09-17

Read more about Life Insurance is for EveryoneLife Insurance is for Everyone

Life Insurance: Not Just for the Rich—Why You Can Afford It Too! When you hear “lif...

Personal Finance

2024-09-16

Read more about 10 Steps for Dealing with Financial Stress10 Steps for Dealing with Financial Stress

Dealing with financial stress can be overwhelming, but with a systematic approach, ...

Investments

2024-09-15

Read more about Roth IRA vs Traditional IRARoth IRA vs Traditional IRA

Planning for retirement is crucial for financial security in your golden years. Two ...

Personal Finance

2024-09-11

Read more about Building Credit with a Starter LoanBuilding Credit with a Starter Loan

A Guide for Young Adults So, you're stepping into the world of adulthood and startin...

Insurance

2024-09-10

Read more about Saving Money on Auto InsuranceSaving Money on Auto Insurance

Saving money on car insurance is a goal shared by many drivers, as premiums can oft...

Personal Finance

2024-09-09

Read more about Understanding Student LoansUnderstanding Student Loans

Student loans are a critical part of higher education financing for many students. U...

Personal Finance

2024-09-08

Read more about Back to School - Tax HolidayBack to School - Tax Holiday

As the relaxing days of summer begin to fade, the excitement of a new school year a...

Home

2024-09-07

Read more about How to Own Your First HomeHow to Own Your First Home

10 steps to Your First Home 1. Assess Your Financial Situation Determine how much y...

Vehicle

2024-09-06

Read more about Refinancing Your Way to Savings: Auto LoansRefinancing Your Way to Savings: Auto Loans

Refinancing your auto loan can be a strategic financial move, potentially saving yo...

Personal Finance

2024-09-05

Read more about The Importance of an Emergency FundThe Importance of an Emergency Fund

When life throws you a financial curveball, having an emergency fund can be the dif...

Personal Finance

2024-08-26

Read more about Revolving Credit vs. Installment LoansRevolving Credit vs. Installment Loans

Which Should You Choose? When it comes to managing your finances, understanding th...

Personal Finance

2024-08-19

Read more about Financial Tips for Freshmen College StudentsFinancial Tips for Freshmen College Students

As a new college student, managing your finances can be overwhelming. However, with...

Home

2024-07-08

Read more about Land LoansLand Loans

What They Are and Why You Would Want One Buying land can be a significant investmen...

Online Services

2024-06-06

Read more about How to Bank on the GoHow to Bank on the Go

In today's fast-paced world, convenience is critical. Texas Bay Credit Union has rec...

Personal Finance

2024-05-31

Read more about Low Cost Ways to Celebrate SummerLow Cost Ways to Celebrate Summer

Summer is the season we all look forward to: vacations, concerts, outdoor events, an...

Investments

2024-05-20

Read more about Managing Retirement IncomeManaging Retirement Income

Tips & Strategies for Making Your Savings Last Retirement marks a significant trans...

Home

2024-05-16

Read more about Saving Money on Your MoveSaving Money on Your Move

A Moving & Storage Guide Moving to a new home can be an exciting but costly endeavor...

Personal Finance

2024-05-16

Read more about Planning Your Dream WeddingPlanning Your Dream Wedding

Plan for Your Special Day with Texas Bay! Wedding bells are ringing, and love is in...

Investments

2024-05-06

Read more about How to Choose the Right CD TermHow to Choose the Right CD Term

Balancing Risk and Reward Certificates of Deposit (CDs) are a popular savings tool ...

Personal Finance

2024-05-02

Read more about Are You Ready for Hurricane Season?Are You Ready for Hurricane Season?

A Guide to Preparation Texas heat brings the presence of summer, but summer in the...

Insurance

2024-04-24

Read more about Understanding Flood InsuranceUnderstanding Flood Insurance

Navigating Insurance Essentials Insuring Against the Deluge Floods are among the...

Home

2024-04-22

Read more about Find the Best Mortgage for YouFind the Best Mortgage for You

Unlock Your Dream Home: Exploring Mortgage Options with Texas Bay Credit Union T...

Business

2024-04-18

Read more about Zelle for Small Business - Best PracticesZelle for Small Business - Best Practices

Empowering Texas Bay Small Businesses: Unlocking the Potential of Zelle Texas Bay ...

Personal Finance

2024-04-15

Read more about Internships UnveiledInternships Unveiled

A Dual Perspective on Professional Development Texas Bay delves into the dynamic ...

Home

2024-04-08

Read more about What You Need to Know About Home Equity LoansWhat You Need to Know About Home Equity Loans

Home equity loans offer a viable option for homeowners to access cash by borrowing ...

Checking

2024-03-25

Read more about Credit Union Checking is a Smart MoveCredit Union Checking is a Smart Move

Opening a Perks or Premium Perks Checking account with Texas Bay Credit Union isn't ...

Personal Finance

2024-03-21

Read more about Beware of Debt Relief CompaniesBeware of Debt Relief Companies

A Comprehensive Guide to Understanding, Avoiding, and Seeking Alternatives In times...

Personal Finance

2024-02-08

Read more about Navigating Tax SeasonNavigating Tax Season

As we enter tax season, individuals and businesses alike find themselves immersed in...

Personal Finance

2024-01-30

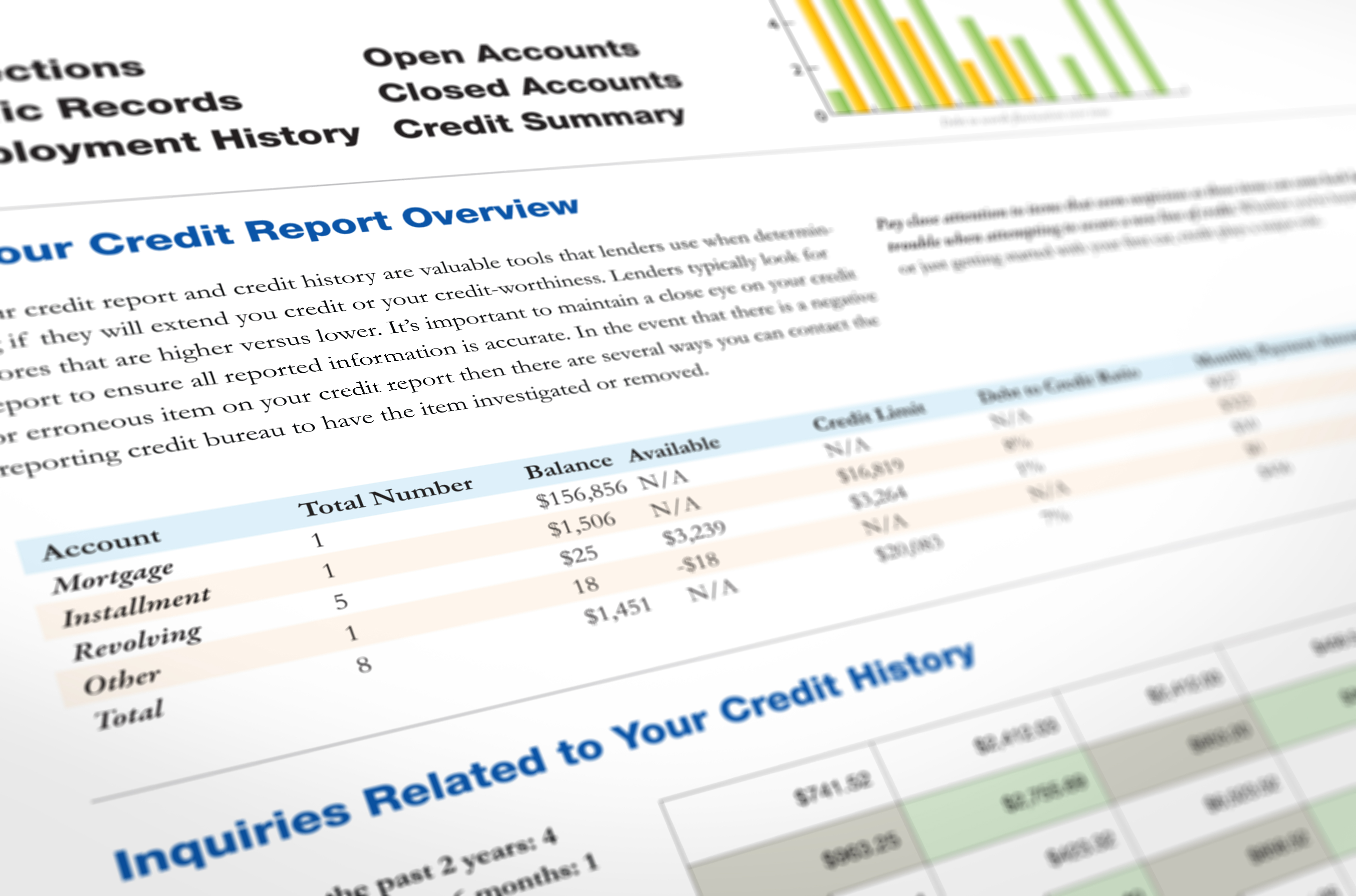

Read more about Risk of Using Credit Repair CompaniesRisk of Using Credit Repair Companies

In the quest for a better credit score, many turn to credit repair companies, entic...

Personal Finance

2024-01-18

Read more about Learn and Earn with ZogoLearn and Earn with Zogo

Adulting can be hard with the constant flurry of busy schedules, but we want you t...

Personal Finance

2024-01-08

Read more about Understanding Your Credit ScoreUnderstanding Your Credit Score

Your credit score is more than just a number; it's a vital indicator of your financ...

Personal Finance

2024-01-03

Read more about Guide to Setting Financial GoalsGuide to Setting Financial Goals

It’s a New Year… time to think about your goals for the year. Are you planning to b...

Personal Finance

2023-12-21

Read more about Post-Holiday Shopping - Yes, It's a Thing!Post-Holiday Shopping - Yes, It's a Thing!

How to Save Money While Giving! Something about shopping during the holidays make...

Security

2023-12-18

Read more about Safety Checklist for Using Credit Cards OverseasSafety Checklist for Using Credit Cards Overseas

Traveling abroad can be an exciting adventure but it requires careful planning, esp...

Personal Finance

2023-11-20

Read more about Your Ultimate Financial Gift-Giving GuideYour Ultimate Financial Gift-Giving Guide

Be Financially Thoughtful This Holiday When showing your love and appreciation, g...

Vehicle

2023-11-14

Read more about New vs. Used Car PurchaseNew vs. Used Car Purchase

Making the Right Choice: New or Used Cars for Your Holiday Purchase Amid the end-of...

Vehicle

2023-11-14

Read more about Find Your Next Car from HomeFind Your Next Car from Home

All in One Car Buying Experience Let's be honest; not very many enjoy the car-buy...

Personal Finance

2023-10-23

Read more about Credit Union vs. Bank - Which is Right for You?Credit Union vs. Bank - Which is Right for You?

When looking for a place to manage your money, the decision often comes down to two...

Personal Finance

2023-09-11

Read more about The Importance of Saving & Building CreditThe Importance of Saving & Building Credit

A Guide for Teens As a teenager or young adult, you may not have thought much about...

Savings

2023-08-02

Read more about Building Your Savings with a Credit UnionBuilding Your Savings with a Credit Union

Tips and Strategies for Growing Your Money Saving money is an essential part of ach...

Investments

2023-05-22

Read more about CDs in TexasCDs in Texas

As a Texas resident, you have several options when it comes to investing your money....

Home

2023-04-10

Read more about Make Your House Work for YouMake Your House Work for You

Home Equity Lines of Credit... DID YOU KNOW? Do you know how your home’s equity c...

Personal Finance

2023-03-06

Read more about Spring Break Savings TipsSpring Break Savings Tips

Get ready for a week of fresh flowers and greens coming your way! Spring break is t...

Savings

2023-01-11

Read more about How to be Successful at SavingHow to be Successful at Saving

Get a Fresh Start to Saving Money! You start fresh each year, and every year you ...

Home

2023-01-03

Read more about Reasons to Consider Refinancing Your MortgageReasons to Consider Refinancing Your Mortgage

For many homeowners in Houston, refinancing their homes can be a smart financial mo...

Security

2022-10-10

Read more about Keep Yourself Cyber SafeKeep Yourself Cyber Safe

Our world relies on the internet now. Whatever we do is being tracked daily by com...

Security

2022-10-10

Read more about How to Protect Yourself from Common Banking ScamsHow to Protect Yourself from Common Banking Scams

At Texas Bay Credit Union, we prioritize your financial safety. As technology advan...

Vehicle

2022-01-10

Read more about The SaveEasy Auto LoanThe SaveEasy Auto Loan

Better Than a Lease! Ready for a financing option that allows you to get behind the...

Business

2022-01-04

Read more about Top 4 Reasons to get a Business Credit CardTop 4 Reasons to get a Business Credit Card

Running a business can be difficult. From managing employees to building a client b...